This is posted to the Accounts Receivable T-account on the debit side. This is posted to the Service Revenue T-account on the credit side. This is posted to the Accounts Payable T-account on the credit side.

How confident are you in your long term financial plan?

- All of these columns use source documents that were acquired throughout the voucher system.

- On the other hand, assets sold in cash are recorded in the cash book and the sales of assets on credit are recorded in the proper journal.

- For example, selling goods for cash is always a debit to Cash and a credit to Sales recorded in the cash receipts journal.

- It regularly orders food and supplies for its bar from various suppliers.

- The journal also includes the recordation date, the name of the supplier being paid, a source document reference, and the invoice number.

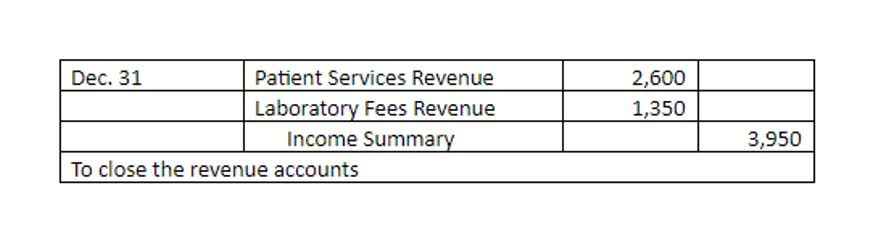

- A compound entry is when there is more than one account listed under the debit and/or credit column of a journal entry (as seen in the following).

The first is a debit from an expense account and the second is a payment to the company or service provider. Businesses often have expense accounts set up to make budgeting purchases journal example easier. You need to note which account funds are taken from to pay for a purchase. It can help you track the expenses of your business, which can be useful for tax purposes.

Institutional Review Board Statement

And if Mr. Smith said, “I thought I paid part of that two weeks ago,” the company would have to go through the general journal to find all payment entries for Mr. Smith. Thus, recording all transactions to the general journal makes it difficult to find the particular tidbits of information that are needed for one of our customers, Mr. Smith. The use of special journal and subsidiary ledgers can make the accounting information system more effective and allow for certain types of information to be obtained more easily.

Posting Entries to Purchase Returns and Allowances Journal

Note that the information for both the cash receipts journal and the cash disbursements journal are recorded in the general ledger Cash account. And the accounts receivable subsidiary ledger for Baker Co. would also show the payment had been posted (Figure 7.22). The information in the sales journal was taken from a copy of the sales invoice, which is the source document representing the sale. The sales invoice number is entered so the bookkeeper could look up the sales invoice and assist the customer. One benefit of using special journals is that one person can work with this journal while someone else works with a different special journal.

However, most firms enter those transactions in the general journal, along with other transactions that do not fit the description of the specific types of transactions contained in the four special journals. The general journal is also necessary for adjusting entries (such as to recognize depreciation, prepaid rent, and supplies that we have consumed) and closing entries. For example, a $100 sale with $10 additional sales tax collected would be recorded as a debit to Accounts Receivable for $110, a credit to Sales for $100 and a credit to Sales Tax Payable for $10.

- The larger the business, the greater the likelihood that that business will have a large volume of transactions that need to be recorded in and processed by the company’s accounting information system.

- As a result, it must complete dual aspects before posting it to the ledger.

- If we paid this month’s phone bill of $135 with check #4011, we would enter it as shown in Figure 7.26 in the cash disbursements journal.

- The use of a reference code in any of the special journals is very important.

- In merchandising, a return occurs when a customer returns to the seller part or all of the items purchased.

It is similar to the sales journal because it has a corresponding subsidiary ledger, the accounts payable subsidiary ledger. Since the purchases journal is only for purchases of inventory on account, it means the company owes money. To keep track of whom the company owes money to and when payment is due, the entries are posted daily to the accounts payable subsidiary ledger. Accounts Payable in the general ledger becomes a control account just like Accounts Receivable. If we ordered inventory from Jones Mfg. (account number 789) using purchase order #123 and received the bill for $250, this would be recorded in the purchases journal as shown in Figure 7.28. To keep accurate records, company operations must be considered.

Do you own a business?

- The current purchasing process control can be monitored using accounting software that can manage cash flow and purchase submissions from each supplier.

- The accounting principle required the entity to record all of those transactions as liabilities.

- Using a sales journal significantly decreases the amount of work needed to record transactions in a manual system.

- When the customer pays the amount owed, (generally using a check), bookkeepers use another shortcut to record its receipt.

- As the business maintains control accounts in the general ledger, the accounts payable ledger itself is not part of the double entry bookkeeping, it is simply a record of the amounts owed to each supplier.

Leave a Reply