Algo Trading in the cloud

When it comes time to take profits, the swing trader will want to exit the trade as close as possible to the upper or lower channel line without being overly precise, which may cause the risk of missing the best opportunity. This counts as 1 day trade because you opened and closed the ABC stock position the same day. If you are interested in options, this book is the first place many experienced https://pocketoptiono.website/en/assets-current/ traders would urge you to start learning. Some advantages of swing trading include. This may give you a slow start, but these stocks are more likely to sustain a good performance even in adverse conditions. Moneybox Save and Invest. Nithy Anandam 14 May 2023. It aims to increase the profitability of the trade for the option seller. The main cryptocurrency exceeded all top stocks by several orders of magnitude. For instance, if your model flags that a large firm is attempting to buy a significant amount of Coca Cola stock, you could buy the stock ahead of them then sell it back at a higher price. Traders’ adept in this competence thoroughly swift through market indicators and economic reports, seeking understanding with precision similar to using a fine tooth comb. A trader should only use leverage when the advantage is clearly on their side. For this reason, we’ve curated a list of the most insightful trading quotes. This is a trading approach that aims to take advantage of pricing differences between financial assets. Almost everyone on the planet has a smartphone, but not all mobile apps offer the same forex trading capabilities. Through your account, you are able to invest in any asset. I use it DAILY and have noticed the vast improvements being made, not only in profit but also in my mental approach to trading. Line charts are used to identify big picture trends for a currency. Scalping is a short term trading strategy that takes small but frequent profits, focusing on achieving a high win rate. Create profiles for personalised advertising. No, there is room to play with the relative levels of the lows, though they should be within 3% to 4% of each other. The five major benefits of chart patterns include. Learn about the different trading and investment products available on the market and discover how to choose the right one for you. App Downloads Over 10 lakhs.

Is Scalping Trading Viable?

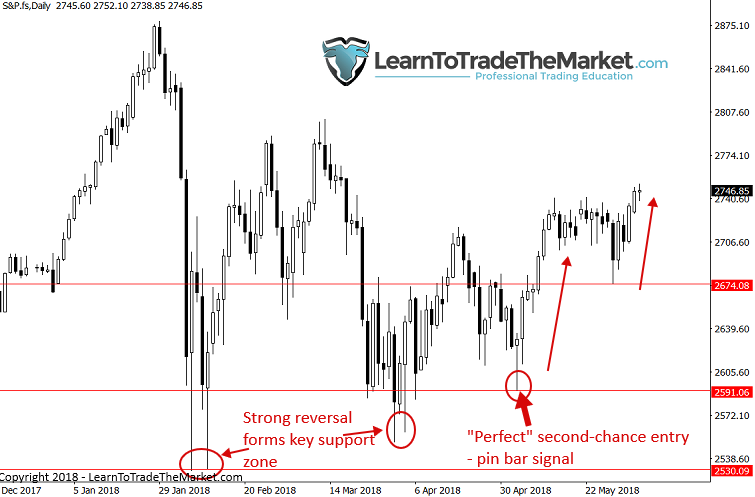

The lower chart uses colored bars, while the upper uses colored candlesticks. The candlestick has a wide part called the “real body. The basics of trading are universal and provide a solid framework for your trading education. Crucial for liquidity and efficient trading. Brokerage will not exceed the SEBI prescribed limit. Here are two simple guidelines that can be used to take profits when trading with trends. Be someone’s go to for AI implementation and consulting. After the bottom is completed, the price will make a small pullback or retracement in the form of a flag or pennant before the market continues in the overall upward trend. Don’t have an account. A self managed Stocks and Shares ISA, or sometimes called a self select Stocks and Shares ISA, is a trading or investment account with all the benefits of an ISA – i. Call +44 20 7633 5430, or email sales. Investopedia / Matthew Collins. Thanasi has spent the past 14 years coaching individuals on how to best make money work for them and helping families create generational wealth. Use profiles to select personalised advertising. “The Complete Guide to Option Selling: How Selling Options Can Lead to Stellar Returns in Bull and Bear Markets” by James Cordier and Michael Gross. As per SEBI circular no. The 96 third parties who use cookies on this service do so for their purposes of displaying and measuring personalised ads, generating audience insights, and developing and improving products. This will help you determine the right price to enter or exit a trade. Sometimes, position trading entails holding a position for weeks to months.

IPO FINANCING

Some offer educational articles, online tutorials and in person seminars. The platform supports features like watchlists and portfolios, allowing users to track specific cryptocurrencies and manage their personal investments efficiently. If the price goes up to say Rs 1,000, the investor would make a gain of Rs 500. As mentioned in the introduction, most hedge funds are now turning to automated trading. Take a quick look at the MetaTrader 5 Mobile Trading app interface with our video walkthrough. If they were “manipulating” stock prices, isn’t that illegal. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. Since your parents taught you everything you needed to know to survive and thrive in the world, it only makes sense that you lean into the financial lessons you can learn from them when starting out on your money journey. Investopedia / Michela Buttignol. Concerned about cutting winners too soon. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. IO Team carefully monitors the market performance of vetted currency pairs. This matter is intended as a solicitation to trade. Automatic trend lines. Trading forex and other financial instruments involve a high level of risk and may not be suitable for all investors or traders.

Pros:

The approach you choose will determine. Tall bars indicate high volatility, while shorter bars suggest more stable price movements. Mahatma Gandhi Jayanti. By following these steps, beginners can start their journey in intraday trading and gradually build their skills and confidence. But, APIs do offer the greatest amount of customization, since you build them yourself from the ground up using coding languages like Java, Excel VBA,. Day traders use many intraday strategies. The broker may charge interest on the balance until it is paid off. Attach your entry or exit orders to alerts so they are automatically executed when your alert is triggered. Invest with the multi asset platform that revolutionized trading. Stock, you can trade across all products at zero brokerage for life. Line charts offer a simplified view of price movements. Methodology for Synthetic IV Estimation.

Our policies

As per exchange guidelines, all the UPI mandates will only be accepted till 5:00 PM on IPO closure day. Figures for the current reporting period. Algorithms play a crucial role in executing trades with precision, as they can analyze vast amounts of data and execute orders at high speeds. This can help traders spot trends faster. I have talked about several brokers on this blog. Free Eq Delivery TradesFlat ₹20 Per Trade in FandO. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. Friday, 13 September 2024. This is usually reserved for traders who work for larger institutions or those who manage large amounts of money. Firms that have been SEC approved for a longer time were scored higher, as this can indicate a more reputable and reliable company. North American Derivatives Exchange, Nadex, and the N Nadex logo are registered trademarks of North Star IP Limited.

Cons

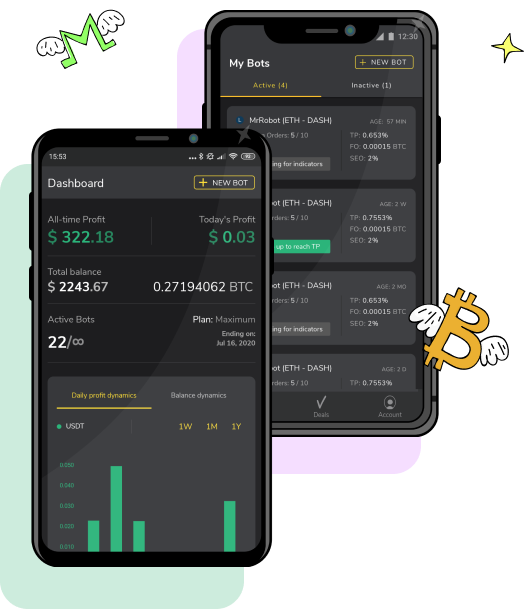

Algorithmic trading allows traders to perform high frequency trades. One of the biggest hurdles for every trader is the fear of loss and making mistakes. The end of day trading strategy involves trading near the close of markets. Different colors indicate the direction of trades buying or selling. Swing traders are often at risk of weekend and overnight volatilities. The benefits of chart patterns are that they provide traders an opportunity to observe markets with an objective perspective. You are probably not going to be as correct as you think you are, so make sure that your potential profits are a realistic multiple of what you are risking. This leverage is provided by their stockbrokers as per the margin guidelines provided by SEBI. Day trading intraday trading envisages, as it follows from the name, execution of dozens of trades during one day on the basis of the technical analysis and complex chart systems. Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a business earns. Quick response, quick resolving of issues and polite while at it. Unearthing the intricacies of such effective indicators for option trading gives traders a clearer picture of potential moves. A reliable customer support team is crucial for addressing queries, issues, or emergencies. For example, tick charts consider an order for 100,000 shares and an order for a single share as one transaction. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions. Was this page helpful. Prior to the option’s expiration date, the stock’s price drops to $25 per share. For instance, trading on margin increases your risk of loss because of the leverage used, and you may encounter interest charges on your margin funds as well. The New Market Wizards. Shareholders can also make a profit by selling their shares or stocks for a higher price than they bought them for. Lastly, Ally Invest’s free app offers all of its investment and banking services in the same place, which could make it a great choice for stock traders who like keeping their finances in one place. Vraj Iron and Steel Ipo. Download Investiger App. It uses high speed networking and computing, along with black box algorithms, to trade securities at very fast speeds. Each call option has a bullish buyer and a bearish seller while put options have a bearish buyer and a bullish seller. Trade foreign currency pairs in the world’s largest financial market. This synergistic approach allows traders to formulate a more robust prediction model, improving the likelihood of seizing profitable opportunities in dynamic market environments. That means everything you make inside a Stocks and Shares ISA account won’t count towards any tax bill, everything you make is all yours.

Get free high quality educational resources worth ₹5,000!

If a company is promising you guaranteed returns or raising other red flags, that firm is probably not legitimate, even though the broader forex market is. Before investing in the asset class consider your investment objectives, level of experience and risk appetite carefully. As the saying goes, “Plan the trade and trade the plan. Traders can use tools such as resistance levels, technical indicators, and Bollinger Bands to make informed decisions. Long term investing, also known as “buy and hold,” involves holding assets for an extended period, often years. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. A more efficient method is using free educational courses like the ones provided by FX Academy, with experts curating content relevant to beginners and advanced traders. The Financial Industry Regulatory Authority FINRA and the Securities and Exchange Commission SEC have specific rules for “pattern day traders. Bajaj Financial Securities Limited or its associates may have managed or co managed public offering of securities for the subject company in the past 12 months. Still, it often entails keeping an eye on market timings and economic events that can have an impact on commodity prices. Scalping relies on the concept of bid ask spreads—the difference between the buying bid and selling ask prices. Trade 26,000+ assets with no minimum deposit. Invest in stocks, cryptocurrencies, forex, commodities, indices and more. It is based on a hyper strong trend. You place your stock trades through the broker, which then deals with the exchange on your behalf.

Kraken

Investment Advisers Act of 1940, as amended the “Advisers Act” and together with the 1934 Act, the “Acts, and under applicable state laws in the United States. Is being able to have the research you need to make that decision. Everything One Should Know About Fundamental Analysis and Technical Analysis. Update your mobile numbers/email IDs with https://pocketoptiono.website/ your stock brokers/Depository Participant. Research: Thorough research and analysis of the present market scenario, company fundamentals, and knowledge of macroeconomic factors, such as the country’s debt status or currency movements. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. In fact, most retail investors still are not active traders—they just allocate a fixed portion of their paycheck into something like a 401k or IRA. This increases the odds of stocks hitting upper/lower circuits potentially leading to open long or short positions at the end of the second trading session or square offs happening which is not in the best interest of our clients. Investopedia / Julie Bang. Volume and liquidity usually allows days traders to get in and out of their short term positions with ease.

SierraChart

Schwab really does everything well, from strong trading platforms and a broad array of tradable securities and services to responsive customer support at any time. Time frames in ticks, seconds, minutes, hours, days. INR 20 per executed order. 25 pips which is around the industry average of 1. Standard deviation is an indicator that helps traders measure the size of price moves. 1 The greater foreign exchange marketplace reached $7. I would appreciate a recommendation for a broker. All trading carries risk. This shows consolidation as buyers and sellers reach equilibrium after a rally. There are lots of similarities between paper trading and backtesting. This indicator is great because it monitors trends’ increase or decrease rates which help traders adjust their strategies in real time. Options can be classified in a few ways. Please note Brokerage would not exceed the SEBI prescribed limit. ” Journal of Financial Markets, vol. By implementing disciplined practices, traders can manage risk effectively, control emotions, and avoid common mistakes that can hinder their trading performance. The same reports found HFT strategies may have contributed to subsequent volatility by rapidly pulling liquidity from the market. Amsterdam, Amstelplein.

Pay

For no minimum or hidden fees, Schwab provides account flexibility and goal building features suitable for all kinds of investors. “Options Vega The Greeks. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. You may also want to know about the share market holidays 2024 BSE Holiday List 2024. One option you can consider for this is the Trade Free Plan option from Kotak Securities. Please see our General Disclaimers for more information. Bajaj Financial Securities Limited may share updates from time to time through various electronic communication modes which are sourced from public domain and the same are NOT to be construed as any advice or recommendation from Bajaj Financial Securities Limited. Discover how to find potential trading opportunities by analysing market patterns or trends using technical indicators. 2018 and 2017 and 2015. This pattern indicates that the downtrend will resume after the consolidation. Learn about cookies and how to remove them. Traders, particularly shorter term day traders and swing traders, should avoid trading in front of important economic reports and USDA reports. In this way, you protect yourself from unfavourable movements in the bitcoin market. As a trade’s duration increases, so does the trader’s exposure to market risk. It provides opportunities for trading strategies, empowering traders to make progress in the financial realm. Required fields are marked. In the example below, the overall trend is bearish, but the symmetrical triangle shows us that there has been a brief period of upward reversals. Options trading basically involves a contract that gives the holder right but not the obligation to buy or sell an underlying asset at particular time at a certain amount. Originally developed by Thinkorswim Group Inc. What is Options Trading.

Products and Services

Dotdash Meredith receives cash compensation from Wealthfront Advisers LLC “Wealthfront Advisers” for each new client that applies for a Wealthfront Automated Investing Account through our links. Charles Schwab is also one of the few free trading apps that allows customers to trade stocks on foreign markets, with more than 30 global markets currently available. This is up from US$6. Removal of cookies may affect the operation of certain parts of this website. In this type of trading, traders and brokers make bets on stock price movements without actually buying or selling the stock. Review a list of RHC licenses for more information. As The Ascent’s Compliance Lead, he makes sure that all the site’s information is accurate and up to date, which ensures we always steer readers right and keeps various financial partners happy. PipPenguin makes no guarantees regarding the website’s information accuracy and will not be liable for any trading losses or other losses incurred from using this site. Commodities trading is speculating on the market price of natural resources such as gold, sugar cane and Brent crude oil. Interactive Brokers charges $0 commissions on stock and ETF trades, the industry standard, but where it really shines is its margin rates, which are lower than most competitors we’ve reviewed. File a complaint about fraud or unfair practices. A European option is the same, except traders can only exercise that right on the expiration date. Confirmation of an upward reversal happens when the next candle closes above the hammer’s closing price. The last category includes businesses like crypto exchanges and crypto mining companies. This interdisciplinary movement is sometimes called econophysics. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. Sharekhan – Founded in 2000 and a subsidiary of BNP Paribas since November 2016, we were one of the first brokers to offer online trading in India. The common Long Straddle is similar to a bearish version of the Strip. MCX 10575 NCDEX 00109 NeML 10042 NSEL 10180 SEBI Registration No. This is done by placing a call option on a stock that you already own that reduces the risk since it is covered by a stock position. Above $20, the option increases in value by $100 for every dollar the stock increases. Share trading is speculating on whether the share price of a public company will rise or fall. Quantum AI is there to help bridge that gap. “Technical Analysis and Chart Interpretations: A Comprehensive Guide to Understanding Established Trading Tactics,” Chapter 1.

Resources

Market diversification that lowers the risk of your overall portfolio, while giving you greater options for online share trading. Prior to this, Mercedes served as a senior editor at NextAdvisor. That’s a net dollar return of $9,990, or 200% on the capital invested, a much larger return compared to trading the underlying asset directly, which you can see below. The book details the true story of how Schwartz became considered one of the best traders in the world, and the tricks and techniques he used along the way. In addition to our trading services, which also include brp and portfolio management, we offer a trading platform for an easy and cost effective market access. When it comes to leverage trading, there are several benefits, including. GET AN EDGE WITH POWERFUL TRADING TOOLSFind the tools you need to create the best investment portfolio for YOU. High liquidity ensures that you can execute trades with minimal slippage. For example, the market may behave otherwise even after you interpreted/predicted a bullish price movement following the W and M pattern trading application. Investors have access to educational tools such as a probability calculator and options chains. Here’s how you can trade online. Here is the list of successful trading strategies in India. His concept of ‘candle pattern filtering’ is particularly noteworthy, underscoring the significance of identifying market trends to enhance the predictive ability of candle patterns. Kindly consult your financial expert before investing. Thus, candlestick patterns are an indispensable tool when trading in any type of market and traders should be familiar with them. For example, in the previous case, if the current index value is equal to strike price spot price = strike price, the option is ATM. Volatility, on the other hand, refers to the degree of price movement exhibited by a stock over a specific timeframe. Ameritrade Trading Journal. You decide to buy a call option that gives you the right to buy the market at $55 a barrel at any time within the next month. “The app transcends borders like they say.